COVID-19 Tax Credits For Businesses

Tax Attorney, Ian Alden recently hosted an important and informative workshop where you can learn about the COVID-19 tax credits available for your business to take advantage of. We may...

Tax Attorney, Ian Alden recently hosted an important and informative workshop where you can learn about the COVID-19 tax credits available for your business to take advantage of. We may...

In the case of South Dakota v. Wayfair, Inc., the Supreme Court of the United States allowed the State of South Dakota, under a law it had passed, to require...

A Free Operating Agreement Template doesn’t make anyone money, so you have to wonder why companies make them available? As a law firm, it probably wouldn’t surprise you to hear...

The Operating Agreement acts like a “partnership agreement” between the owners of a LLC. Important clauses for LLC Operating Agreements are critical, and a well-written and customized Operating Agreement for...

If you’re familiar with the different types of businesses out there, you’ve probably heard something about an S Corporation or “S-Corps”. Maybe a friend or colleague told you about some...

If you’re starting a new business (or reorganizing an old one), you have a few options to choose from. For example, you could form a Limited Liability Company (or LLC)....

December. The last month of the year. In approximately 31 short days from when this blog article is published, we will enter the 2018 new year. For business owners, January...

What can you do when your New Mexico Business owes back taxes? We explain what a Managed Audit is and how it can possibly help your business.

(The information in this post is now outdated. As of 2021, your CRS number is now a BTIN. Please refer to this new post instead.) New Mexico CRS Identification Numbers...

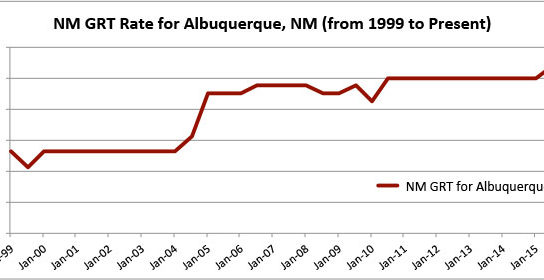

Know Your Gross (Receipts Tax)! Do you know what your Gross Receipts Tax (GRT) is? As a business owner, this little morsel of information is pretty important — especially because...