New Mexico Companies – Your Gross Receipts Tax is Changing Again!

Do you know what your Gross Receipts Tax (GRT) is? As a business owner, you are responsible for knowing the the New Mexico Gross Receipts Tax (or NM GRT) and responding accordingly. State and federal authorities take taxes very seriously and not knowing is not a valid excuse.

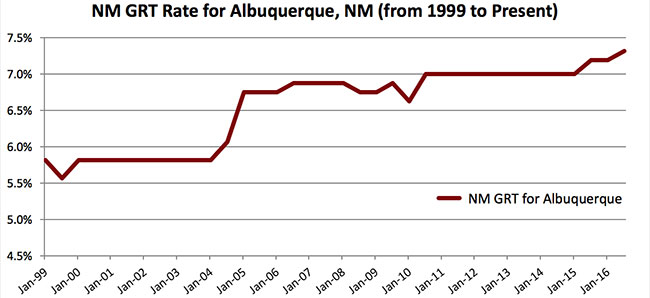

The NM GRT is what is called a “pass-through tax”. We explain NM GRT in another blog article (read it here). The NM GRT “rate varies throughout the state from 5.125% to 8.6875% depending on the location of the business.” Generally speaking, this rate varies because the total rate combines rates imposed by the state, counties, and, if applicable, municipalities where the businesses are located. There are many instances where NM GRT does NOT need to be collected, in the form of exemptions (the sale of which do NOT need to be reported) and deductions (the sale of which DO need to be reported).

2016 NM GRT Changes

Per the NM Taxation & Revenue Department’s Website, the New Mexico Gross Receipts Tax rate has changed for most New Mexico jurisdictions, effective July 1, 2016. Your business is responsible for knowing these changes and responding accordingly. Find out your new tax rate for your location by getting the latest tax schedule here: http://www.tax.newmexico.gov/gross-receipts-tax-historic-rates.aspx

All businesses are responsible for knowing what NM GRT rates to charge.

The rules governing GRT collection are quite complicated. You should always double-check the rules pertaining to your business, goods/services, and your customers, to ensure you’re calculating, charging and reporting taxes properly. L4SB is more than happy to learn about your business and help clarify any tax questions you may have or refer you to the proper tax professional.

Law 4 Small Business, P.C. A little law now can save a lot later.