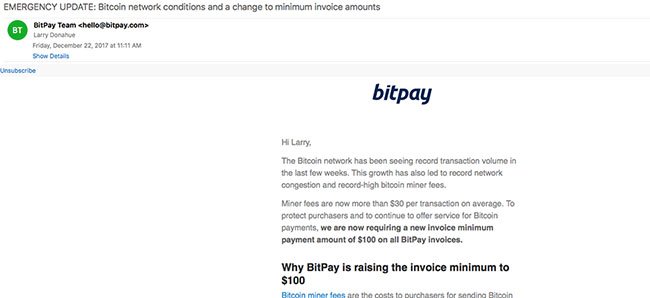

The above image is a snapshot of an email I just received from BitPay, one of the better (in my opinion) merchant tools providers in the bitcoin space (used by NewEgg and other major retailers).

Bitcoin’s success is bitcoin’s doom.

As its popularity mushrooms, so does the transaction processing requirements to facilitate the network. Because of the “proof of work” (or POW) requirements necessary for a decentralized bitcoin network to confirm transactions, it takes brute-force computer effort by many computers (called “miners” in bitcoin-speak) to make that happen. Worse still, as more bitcoin miners come on-line to deal with the demand, the algorithms the computers use to confirm these transactions actually become more difficult, requiring more raw computer power to process the transactions.

Added to this, are limitations in the “blockchain” that defines bitcoin. It’s size is fixed, creating bottlenecks in transaction processing. This means two important things: First, that miners will favor those transactions where they make the most money in processing the transaction (i.e. it’s not first come, first serve; it’s first serve to the highest bidder). Second, that transactions can wait a long time (or even forever), if the transaction fees paid weren’t high enough at the time of the transaction.

What we have is a downward death spiral.

Hence today’s email from BitPay. Here’s what they said:

Hi Larry,

The Bitcoin network has been seeing record transaction volume in the last few weeks. This growth has also led to record network congestion and record-high bitcoin miner fees.

Miner fees are now more than $30 per transaction on average. To protect purchasers and to continue to offer service for Bitcoin payments, we are now requiring a new invoice minimum payment amount of $100 on all BitPay invoices.

Why BitPay is raising the invoice minimum to $100

Bitcoin miner fees are the costs to purchasers for sending Bitcoin transactions. BitPay also pays these costs as an operational cost for sweeping and processing payments received to BitPay invoices.

With current bitcoin network conditions, transactions sent without large miner fees are at high risk of significant payment delays or payment failures. This has meant that bitcoin payments under $100 are quickly becoming impractical for users to send and for BitPay to process.

. . .

You read that right. It’s upwards of $30 (and more) to conduct a transaction on the bitcoin network. Imagine if you had to spend $30 dollars to buy something with your credit card? Just how long would you continue to use such a credit card?

Unfortunately, this problem is not going away, given the inherent structure and design of bitcoin.

Fortunately, there are already alternatives in cryptocurrency: They are called “altcoins,” and you’ve probably heard of “Bitcoin Gold” (BTG) or “Bitcoin Cash” (BTH) or “Zcash” (ZEC), just to name a few. These alternative cryptocurrencies have sprung-up to address some of the shortcomings with bitcoin (for example, blockchains with larger capacities), although if you think it’s difficult to accept bitcoin as a business, you haven’t seen anything. It’s next to impossible to find good merchant account tools that permit businesses to accept alternative cryptocurrency.

As a law firm, we use CryptoWoo to help us accept certain cryptocurrencies (Bitcoin, Litecoin and Dogecoin). It’s actually very good, but it’s acceptance of altcoins is somewhat limited (although it does provide a mechanism to take advantage of ShapeShift to convert cryptocurrencies — we just feel the interface is not quite ready for adoption by the masses).

In short, commerce demands fast, inexpensive transaction processing. This is polar opposite of what bitcoin appears to be capable of given current issues — during a very important time of the year for merchants. I think we’re now seeing clear proof that bitcoin is not the long-term standard for cryptocurrency. Instead, it will be an alternative (i.e. altcoin) — an alternative that does not suffer the transaction processing problems of bitcoin (speed and cost), and is supported by strong merchant processing tools for business.

Today, I cannot tell you which altcoin that will be.

2 Comments

Hi Larry,

This isn’t the first time someone has made the brazen claim that “Bitcoin is Dead!” I’ll make sure your post is added to https://99bitcoins.com/bitcoinobituaries/

Anyways, back to the meat of it all. Since the time of your writing this and my comment, your analysis has become obsolete. There was always a solution to the problems you laid out, this was segwit adoption. Segwit is a second layer solution that allows for more efficient batching of transactions and an increase in blocksize up to 2mb.

As you can see here: https://dedi.jochen-hoenicke.de/queue/#24h

Transactions are now confirming at 5-10 sats which as I’m sure you know is under $1USD.

Not only will segwit help with the fee schedule and transaction speed, it will allow 2nd layer scaling with Lightning Networks. Lightning Networks will allow for instant fee free transactions. Read more here: https://en.wikipedia.org/wiki/Lightning_Network

Amazing how fast technology moves huh?

Needless to say, I wouldn’t put my money on any other coin then Bitcoin.

Thanks for reading!

Segwit is just another bandaid. Simply put, Segwit effectively reduces the size of individual transactions, thereby allowing more transactions/block. Bitcoin without Segwit implementation can handle roughly 2000 transactions/block (given an avg transaction size of roughly 500 bytes) or 3.3 transactions/second given the fixed block generation time of 600 seconds. Adopting Segwit would raise that upper bound to roughly 12000 transactions/block or 20 transactions/s (https://bitcoin.stackexchange.com/questions/59408/with-100-segwit-transactions-what-would-be-the-max-number-of-transaction-confi). The important point here is that Segwit only scales up the total number of transactions/second by a constant factor (~6).

This is simply because the total number of transactions added to the mempool per second have gotten close to or below the 3.3 transaction/second limit, so there is much less contention over block space. If we go back to December when we saw the highest fees and confirmation times, the total number of transactions added to the mempool per second was around 4.5. Obviously, it follows that if BTC had full Segwit adoption in December then we would not have seen the spike in transaction times or fees because 4.5 transactions/second is less than the possible 20 transaction/second capability provided by Segwit. In other words, Segwit effectively raises the average number of possible transactions per day from ~300,000 to 1,730,000. The 1,730,000 number looks quite respectable but remember that it only affords Bitcoin to become 6 times more popular than it is today. After that we arrive at the same problem.

To put this into perspective, PayPal alone processed over 5,000,000 transactions per day in 2011. Larry’s point is that Bitcoin is not proving to be a viable platform to exchange goods and services with. That is not to say that it doesn’t make an excellent money storage platform. I guess the community needs to decide what exactly Bitcoins intended use is.

If Bitcoin generated a block every 60 seconds instead of 600 it could handle 17,280,000 transactions/day, but again we have the same problem. No matter the coin, fixes like Segwit do not address the fundamental problem of fixed constant block generation times and block sizes. I think the solution is far more complex and probably involves scaling those constants in some way, either on a fixed interval or dynamically such that it can adapt to growing requirements while still controlling inflation.